Learn More About Tax Savings on Your Laser Equipment

Maximize Your Tax Savings with Laser Equipment Purchases

As the old saying goes, death and taxes are inevitable—but we can definitely try to reduce the burden of the latter. If you act quickly, you might still be able to save on your taxes by acquiring your new laser equipment before the end of the year. To take full advantage of the enhanced Section 179 tax deductions this year, you'll need to place your order soon and ensure the equipment is operational by December 31st.

Understanding Section 179 Enhancements

Thanks to last year's Taxpayer Relief Act (often referred to as the "fiscal cliff" bill), Section 179 deductions have seen a significant boost for both 2012 and 2013. The deduction limit has increased dramatically from $125,000 to $500,000. Additionally, a 50% bonus depreciation is available for 2013, allowing you to write off your investment much faster. Whether you're purchasing new or used equipment—such as laser welding, marking, or cutting systems—you can benefit from these deductions.

Potential Tax Benefits

Buying your laser equipment now and putting it into service before the end of the year can lead to substantial tax savings. For instance, on a qualified purchase of $25,000 or more, you could potentially save nearly $9,000 in taxes. Furthermore, if you opt for leasing, you can deduct your lease payments and any associated interest for the year. The IRS is also offering a "Bonus Cash" incentive of $179 for every $10,000 financed, whether you choose to buy or lease the equipment—provided you complete the transaction before year-end!

Eligible Equipment and Software

Of course, not everything qualifies for these tax benefits. However, many types of laser equipment, including new machinery, computers, and off-the-shelf software, are eligible. These categories are particularly relevant if you're investing in laser technology for your business.

Financing Options for Laser Equipment

One of the best ways to acquire laser equipment without depleting your cash reserves is through leasing. Instead of paying upfront, you pay for the equipment as it generates revenue for your business. With our flexible financing options, you may even be able to purchase laser machinery without an initial down payment.

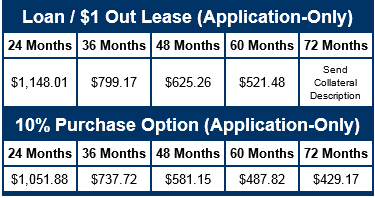

For example, consider a $25,000 piece of equipment financed through a lease:

Adding the $179 per $10,000 financed for the Section 179 cash bonus gives you an idea of the potential savings.

Deferred Payments Until Next Year

The future of Section 179 beyond 2013 remains uncertain, but with the right financing, you can still capitalize on this opportunity. By purchasing your laser equipment now through LaserStar, you can secure the assets you need with no down payment and defer your first payments until 2014. This provides a welcome financial reprieve during the holiday season and helps offset any downtime caused by seasonal closures.

Don't miss out on these valuable tax-saving opportunities. Contact one of our technical experts today to explore how you can maximize your benefits before it's too late.

Note: Lease payments are subject to change based on creditworthiness.

hbspt.cta._relativeUrls=true;hbspt.cta.load(26739, 'dde06b6f-e28e-4a56-92c5-e829f68de19a', {"useNewLoader":"true","region":"na1"});

hbspt.cta._relativeUrls=true;hbspt.cta.load(26739, 'dde06b6f-e28e-4a56-92c5-e829f68de19a', {"useNewLoader":"true","region":"na1"});

Mining Polyethylene Composite Pipe

Cross helically wound steel wires reinforced-polyethylene composite pipe (SRCP) is a kind of composite metal plastic pipe with excellent overall performance. With excellent pressure bearing performance, good flexibility, long-term resistance to acid and alkaline corrosion and abrasion, it is suitable for long-distance underground pipes for water supply and drainage, slurry transportation and the like, especially for subsidence region such as mining area, river channel.

Mining Polyethylene Composite Pipe,Composite Pipe,Composite Mine Pipe,Various Specifications Composite Pipes

SHANDONG EASTERN PIPE CO., LTD. , https://www.dfuhmwpe.com