Learn More About Tax Savings on Your Laser Equipment

Maximize Your Tax Savings with Laser Equipment Purchases

Death and taxes are inevitable, but there are ways to reduce the financial burden of the latter. If you act swiftly, you can still enjoy significant tax benefits by purchasing your laser equipment before the end of the year. To take full advantage of the enhanced Section 179 tax deductions for 2013, you need to place your order immediately and ensure the equipment is operational by December 31st.

Understanding Section 179 Enhancements

Thanks to last year's Taxpayer Relief Act, Section 179 has received a substantial boost for both 2012 and 2013. The deduction limit has increased dramatically, rising from $125,000 to $500,000. Additionally, there's a 50% bonus depreciation available for 2013, allowing you to write off your investment much faster. Whether you opt for new or used equipment, laser welding, marking, and cutting systems qualify for this deduction.

Tax Benefits for Laser Equipment

By acquiring your laser equipment now and putting it to work before year-end, you can achieve considerable tax savings. For instance, on a purchase of $25,000 or more, you could save nearly $9,000 in taxes. Leasing is another viable option, enabling you to deduct lease payments and interest paid throughout the year. Furthermore, the IRS offers a Bonus Cash incentive of $179 for every $10,000 financed—whether you choose to buy or lease your equipment—as long as the transaction is completed before December 31st.

Eligible Purchases

You may wonder how the IRS determines eligibility for these tax benefits. Here's what qualifies:

- All newly acquired capital equipment and machinery for business purposes

- All computers

- All "off the shelf" software

- Office equipment

While other categories exist, laser equipment and associated software are among the most relevant for businesses like yours.

Financing Options for Laser Equipment

One excellent way to acquire the laser technology you need without depleting your cash reserves is through leasing. Instead of paying upfront, you pay as the equipment generates revenue. With our flexible financing solutions, you can even purchase laser machinery without an initial down payment.

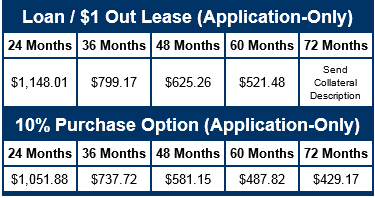

Consider this example of what you might expect with lease financing for equipment costing $25,000:

Adding the $179 per $10,000 financed will give you a rough estimate of your potential Section 179 cash bonus.

No Payments Until Next Year

The future of Section 179 beyond 2013 remains uncertain. However, with appropriate financing, you can still capitalize on this opportunity. By purchasing laser equipment from LaserStar now, you can acquire the necessary tools without an upfront payment and defer any monthly installments until 2014. This arrangement provides a welcome respite during the holiday season and offsets any downtime due to seasonal closures.

These advantages mean there’s no downside to making your laser equipment purchases sooner rather than later. Contact one of our technical specialists today to explore how you can leverage this benefit before it expires.

Note: Lease payments are subject to adjustment based on creditworthiness.

hbspt.cta._relativeUrls=true;hbspt.cta.load(26739, 'dde06b6f-e28e-4a56-92c5-e829f68de19a', {"useNewLoader":"true","region":"na1"});

hbspt.cta._relativeUrls=true;hbspt.cta.load(26739, 'dde06b6f-e28e-4a56-92c5-e829f68de19a', {"useNewLoader":"true","region":"na1"});

Steel Wire Reinforced HDPE Composite Pipe

Steel Wire Reinforced Hdpe Composite Pipe,Hdpe Composite Pipe,Custom Flexible Pipes,Reinforced Polyethylene Pipe

SHANDONG EASTERN PIPE CO., LTD. , https://www.dfuhmwpe.com